[ad_1] The Chinese racer’s lap time was faster than what was managed during testing...

Auto News

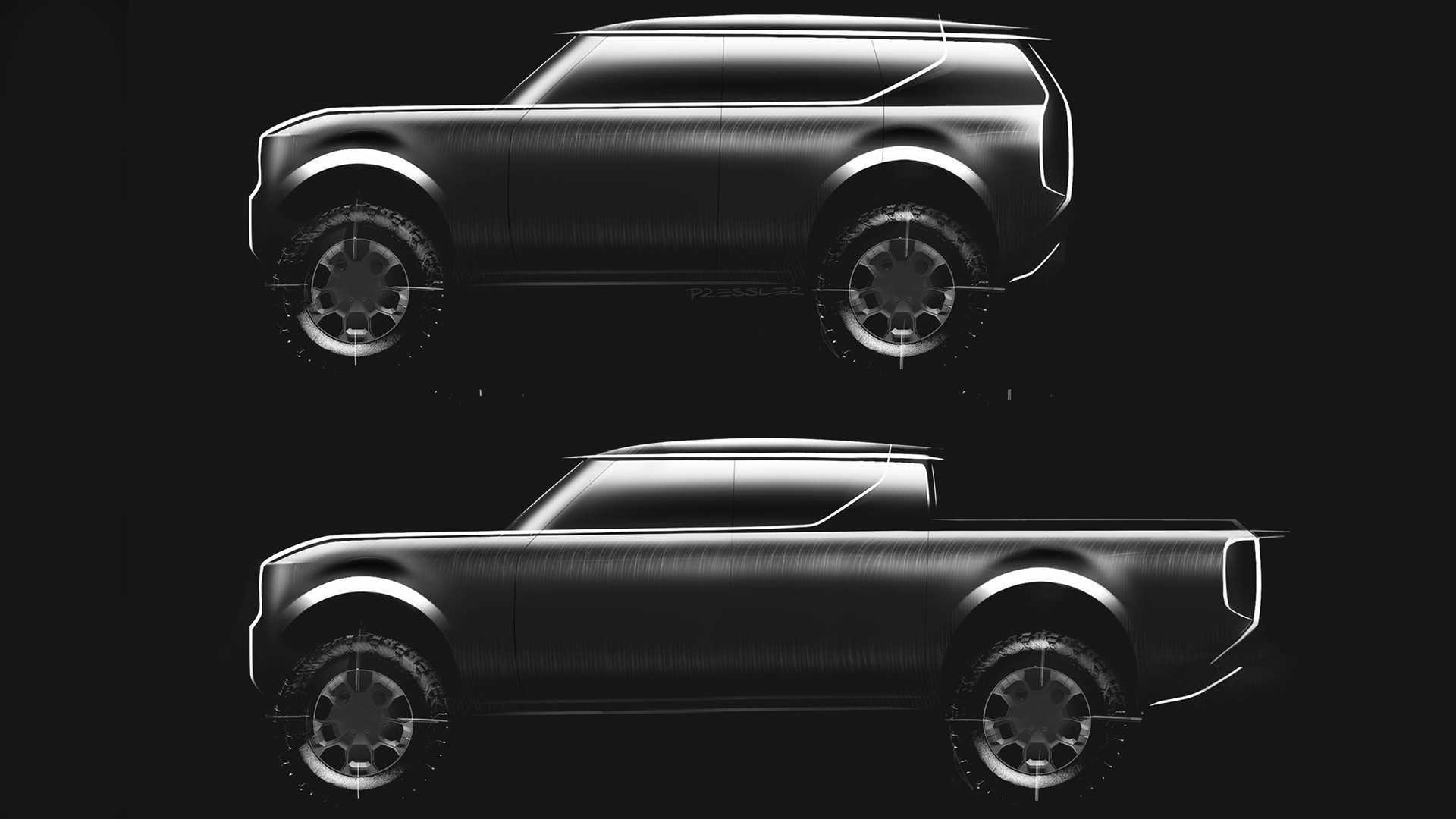

[ad_1] Volkswagen Group will build a factory in the United States specifically for its...

[ad_1] The Volkswagen ID. Buzz – the modern interpretation of the legendary bus –...

[ad_1] Factory driver Preining won twice in Porsche’s first season in the DTM last...

[ad_1] The Philippines, Vietnam and Indonesia are competing to secure an electric-vehicle assembly plant...

[ad_1] Volkswagen Group wants to remain a strong player in Europe and China, but...

[ad_1] Stella says the team will try not to focus initially on direct comparisons...

[ad_1] Ford is betting big on the electrification of its European lineup and wants...

[ad_1] Chevrolet has been producing the Corvette at its plant in Bowling Green, Kentucky,...

[ad_1] The change of specification was formally approved at today’s meeting of the F1...